Previously in A Guide to Investing with Fund That Flip, you learned the benefits of investing in real estate and why Fund That Flip may be a good platform for you. Now that you've invested with Fund That Flip, we'd like to show you how to utilize all the different features we offer to keep track of your investment. Continue reading to learn more!

Deal Page

The deal page provides an in-depth view of the loan structure and the project. Everything from property photos to borrower information to how many interest payments were financed as a part of the loan can be found on this page. The deal page has many different sections that have valuable information for investors:

- Photos & Caption: This section is the first thing you see when you open up an investment. In addition to viewing the property address, you can scroll through the photos to see the current condition of the property (and sometimes the subject to plans). Additionally, the caption provides some brief context on the property specs, FTF ARV, and various borrower information. Last but not least, if the underlying borrower on that loan has repaid at least one other Fund That Flip loan, then there will be a blue “Repeat Borrower” flag on the top left of the photo carousel.

- Updates: Updates do not typically exist when a deal is open for investment. If you’d like to learn more about updates, read the See Your Project’s Progress section below or read What Happens if a Loan Goes Into Default. If you do see any updates here, it may be because the loan is a tranche loan. A tranche loan means that the borrower only pays interest on the outstanding loan balance so their interest payment will increase as they advance work and draw down on construction funds. Because of the way these loans are serviced, Fund That Flip will open them up for investment in the middle of the loan term as they disburse construction funds. Updates will likely exist surrounding the construction progress on these types of loans.

- Investment Summary: This section provides information on the loan closing and the loan structure as well as some varying information on the project. Is the borrower rehabbing an existing house or building a new one? Find out in this section. What is the underlying asset that is securing your investment? Is it a single family? Four family? Multiple properties? You can also find that information in the table that sits at the top of this section. This section will also breakdown how much money Fund That Flip wired at closing, how much is being held back to make interest payments, and how much is being held back in escrow to finance the construction on the project (if any).

This section also includes:- The underlying security of the loan (always has been 1st position).

- The number people who personally guaranteed the loan.

- The date the loan was closed.

- The % of Fund That Flip’s first distribution as it relates to the purchase price and/or the as is value.

- The total construction budget.

- Details on the agreed upon draw process.

- Expected number of construction draws.

- Anticipated exit strategy.

- How much equity the borrower will contribute over the course of the loan.

- The total loan to FTF ARV.

- Prepayment penalty.

- The loan term.

- Details on extensions and/or fees to be paid out to investors.

- Use of Proceeds: This table further breaks down the loan structure and how the loan proceeds compare to the total loan amount. Additionally, the table breaks down the different costs associated with doing the project.

- Loan to Cost: This table also illustrates the costs of doing the project similar to the Use of Proceeds table. It also breaks down how much money Fund That Flip has allocated as a part of its loan to each of those costs as well as the estimated borrower contribution.

- Valuation: The valuation section of the deal page breaks down the different estimated valuations used to make the lending decision. This will always include the FTF Valuation and may also include an appraisal valuation or a broker price opinion valuation. Additionally, the LTV as it relates to each valuation is also provided. You can also see some of the data that Fund That Flip used to develop its internal valuation in this section.

- About the Property: This section is meant to provide as much information about the subject property as we can including its location on a map and the property specs. The property specs provided in this section will always be the after repair property specs. The project details are also included (purchase price, estimated construction budget, FTF ARV).

This section also includes:- Estimated dollar amount of equity contributed by the developer over the course of the project.

- Market Overview: The Market Overview section provides market sales type statistics to help you understand the health of that particular area. Additionally, this section identifies some points of interest that lie near the subject property.

- Project Strategy and Documents: The Project Strategy section will tell you when the borrower purchased the property and also give a short breakdown of the anticipated construction items. The Documents section will include the scope of work and/or construction budget on applicable deals as well as a 3rd party valuation report when they exist (typically an appraisal and/or broker price opinion).

This section also includes:- Borrower’s anticipated exit strategy.

- About the Redeveloper & Previous Projects by the Redeveloper: The About the Redeveloper section is meant to provide as much information on the borrower(s) so that you can make an informed investment decision. It typically includes the number of loans originated with Fund That Flip including the number of repaid loans, how many projects the borrower executes every one to two years, the borrower’s liquidity, and the borrower’s credit score. The Previous Projects by the Redeveloper section displays all the developer’s projects that were financed by Fund That Flip and will indicate if they are currently in term (Fully Funded or Open for Investment) or if they have been repaid. You can click into these projects and browse the photos and updates on them as well to help inform your investment decision.

This section may also include:- What location(s)/market(s) the developer typically executes projects in.

- What types of projects the borrower has executed and/or real estate related experience the borrower has.

- Previous projects completed by the developer that were not financed by Fund That Flip.

- Previous Projects by the Redeveloper.

- Risk: This section includes some common potential risks and mitigating factors that investors should take into account when making an investment decision.

See Your Project's Progress

Fund That Flip’s team provides updates to investors over the life of the loan. These most frequently come in the form of construction draw updates. When a borrower requests a draw, a 3rd party inspector will typically be sent out to the property to take interior and exterior photos and compare the amount of work completed to the borrower’s scope of work. Fund That Flip’s team will review the inspection report to ensure it is accurate before disbursing the construction draw funds. When an update is completed, the update will be created that outlines the amount of work completed and the construction funds disbursed. Additionally, an assortment of the inspection photos will be uploaded to the deal page so that investors can review and monitor construction progress.

Updates are typically posted once every two months at maximum. We post updates as milestones occur which include, but are not limited to construction draws, rehab completion, and properties going under contract to sell.

Utilizing this Information

Investors should review all information provided on the deal page to make an informed investment decision. Understanding the risks of each investment is important prior to investing and Fund That Flip encourages you to due diligence each investment and consult with your investment, tax, and legal advisers before investing. Additionally, updates should be monitored to track the progress of your investment. If any questions should arise during your due diligence or over the course of the loan we encourage you to reach out to a member of our Investor Relations team at investorrelations@fundthatflip.com.

Series Notes

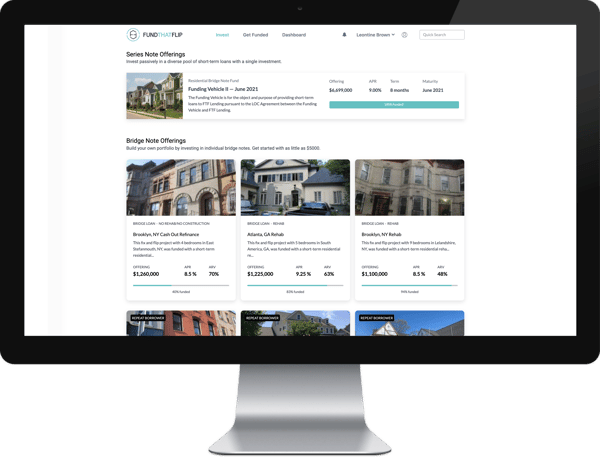

Earlier this year, Fund That Flip was excited to announce the launch of our new Residential Bridge Note Fund (RBNF) and Pre-Funding Note Fund (PFNF). Each fund allows investors to enter a new type of investment strategy when investing with Fund That Flip.

Investing into either Series Note allows investors to select a passive investment strategy, meaning investors will not need to select individual investments. These Series Notes have fixed maturities, as well as a fixed return with monthly interest payments. This allows investors to have greater certainty in their investment around both principal and interest payments. Also, these are high utilization investments, earning interest from the day funds clear escrow.

The main difference between RBNF & PFNF is diversification. By investing in the RBNF Series Note, investors can invest via a series note in a portfolio of whole mortgages and borrower dependent notes, BDN’s, rather than directly and individually in a loan. The mortgages and BDN’s that RBNF hold are a representative set of the book of business of FTF Lending. To date, we have issued eight series notes for RBNF, with durations ranging from 6 to 12 months and 9% - 10% annual returns. To further align Fund That Flip’s incentives with that of our investors, Fund That Flip’s Board of Directors has approved for the Company to invest up to $1M in the Residential Bridge Note Fund. The Company will initially contribute 10% of the outstanding capital raised until the $1M maximum has been reached. This will allow FTF to step into a first loss position to further protect investor’s capital.

By investing in the PFNF Series Note, investors can invest via a series note in a line of credit that PFNF issues to FTF Lending to originate loans prior to either syndicating them on the FTF platform or selling the loans to institutional buyers. To date, we have issued nine series notes for PFNF, with durations ranging from 6-12 months and 8-9% annual returns.

Investors can expect Fund That Flip to post quarterly reports outlining the performances of the two Series. The reports will highlight key metrics in the portfolio such as State diversification, leverage ratios, asset breakdowns, etc. If you have a question about an investment in a Series Note or any other offering, email investorrelations@fundthatflip.com and one of our Investor Relations representatives will be able to help get your questions answered.

Read previous or next article:

Ready to invest? View our open deals and earn as high as 10% annual returns!