Many real estate investors swear by multi-family investments, but investing in single-family homes can also be a great way to increase cash flow and your bottom line. For many, the single-family asset class is also a way to diversify their real estate portfolios. If you're thinking about investing in single-family homes or single-family rentals, here are trends, opportunities and strategies to consider.

Investing in Single-Family Homes

1. Demand remains strong, but affordability is still a concern.

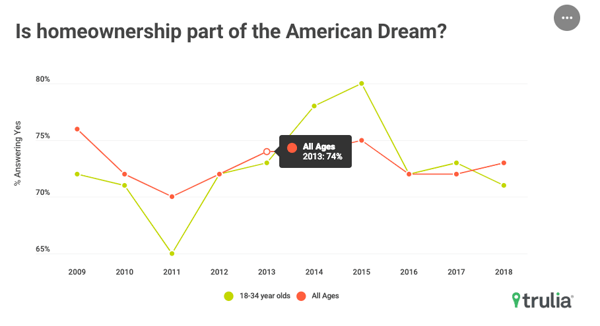

The landscape for investing in single-family homes and rentals will likely be cautiously optimistic. Demand remains strong - a recent survey by Trulia reveals an increase in the number of Americans planning to buy a home, with 40% intending to buy in the next two years. However, the issue of affordability continues to trouble potential homebuyers. More than half of are concerned about saving enough for a down payment, a rate which is even higher among millennials, now the largest demographic cohort of homebuyers. Investors will also need to navigate rising median and mean prices, despite the slight uptick in inventory at end of 2018. Because of this, we expect to see increase activity in more affordable markets.

2. There's a growing demand for single-family rentals.

With affordability still a concern, more and more consumers are deciding to rent. This is particularly true among millennials, whose confidence in being able to save for a down payment is at its lowest level since 2011. Yet as millennials start to have families of their own, we are noticing their needs outgrowing traditional apartments or even 1-2 bedroom rentals. In 2018, we found a growing demand for our single-family rental loan product. We also noted the trend of our customers outfitting single-family rentals with updates attractive to younger families, such as energy-efficient amenities, open floor-plans and green spaces. This demographic shift may be one factor driving the increased demand for single-family rentals and subsequent spike in rent prices. We anticipate that 2019 will offer even more single family investor opportunities to buy, rent, refinance, or sell to turnkey owners seeking these single-family rental properties.

3. Off-market properties and overlooked markets may provide new opportunities for investors.

Competition is growing on the buy side of single-family home real estate investing, with institutional investors selling off considerable portions of their portfolios, and platforms like Opendoor, Knock, and Offerpad attracting busy homeowners looking to sell quickly. Investors should seek creative solutions in a crowded buying landscape. One notable shift in 2018 is many buyers who are investing in single-family homes are increasingly willing to acquire fixer-uppers from channels like the MLS. So, for some investors, it may make sense to develop a robust system for sourcing off-market properties. Single-family home investors should also consider overlooked markets; the largest and most overcrowded, San Jose, San Francisco, and Seattle, saw the greatest decline in prices at 2018 year-end.

4. Many people investing in single-family homes use financing to respond more quickly to market changes.

Many predicted 2018 to be the most competitive home buying year in history, and yet the year ended with a slight cool down in activity and rise in inventory, particularly in the largest markets. In 2019, investors should prepare for longer timelines to sell and budget for either holding the property longer, or anticipate selling at lower prices. Finding the right balance between the two will best prepare them for movements in the market. Similarly, single-family home investors should also consider financing partners who are set up to close on properties quickly and to deftly respond to changes in the industry. The success of many investors will largely depend on their ability to move quickly and find creative solutions to market shifts in 2019 and beyond.

Ready to get funding for your single-family investment property? Apply in less than 5 minutes and get instant feedback on your project: