In line with our goal of industry-leading transparency, Fund That Flip provides stakeholders and lenders relevant statistics related to loan origination and performance. You will also find updates related to technology and offering enhancements herein.

In January, we originated 208 loans and funded $84.5 million in origination volume, one of our strongest months to date. With a strong forward pipeline, we continue to be selective in the loans we choose to fund and the new markets we enter.

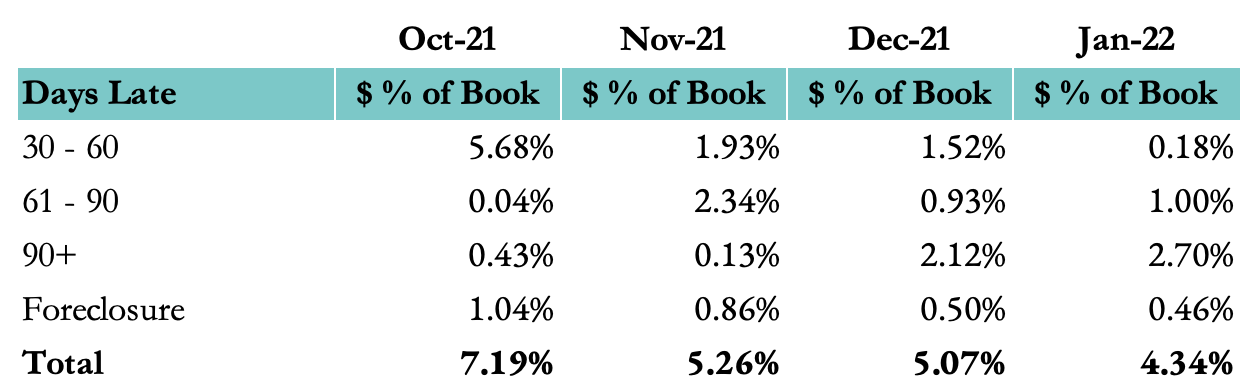

As of January 15th, 4.34% of our book was 30 days or more late on payments. We are continuing to increase our origination volume while monitoring the situation in each market closely. You can read more about our approach to COVID-19 here: Lender COVID-19 FAQs. Moreover, we are working with our borrowers to be supportive in keeping their projects on track and current on interest payments. We also continue to build a strong forward pipeline, meaning we will continue to be selective when deciding which loans to fund.

Learn more about how we handle loans that are 30+ days late in an episode of Investor Insights here.

Success Stories

We are constantly impressed by the quality of work our customers are completing with their funded projects. Check out our recent featured flips to see before and after photos of the homes and communities we're helping to improve.

Thanks for your continued support. We appreciate your business and feedback! Email us at InvestorRelations@fundthatflip.com to schedule a call with a member of our investments team, ask a question or provide feedback.