In line with our goal of industry-leading transparency, Fund That Flip provides lenders relevant statistics related to loan origination and performance. You will also find updates related to technology and offering enhancements herein.

The shutdowns that came along with COVID-19 continued to impact on borrowers' ability to advance projects and list for sale. For this reason, we elected to not originate any new loans in the month of May. You can read more about our approach to COVID-19 here: Lender COVID-19 FAQs. We are monitoring the situation closely and working with borrowers to keep their projects on track and current on interest payments.

We’re encouraged by the positive trends we are beginning to see as it relates to the slowdown of the spread of the virus. States and businesses are beginning to reopen and a new “normal” has begun to emerge. This has allowed us to turn our attention to once again originating new loans in June.

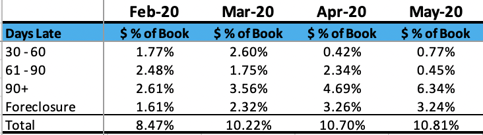

Learn more about how we handle loans that are 30+ days late in an episode of Investor Insights here.

Success Stories

We are constantly impressed by the quality of work our customers are completing with their funded projects. Check out our recent featured flips to see before and after photos of the homes and communities we're helping to improve.

Thanks for your continued support. We appreciate your business and feedback! Email us at InvestorRelations@fundthatflip.com to schedule a call with a member of our investments team, ask a question or provide feedback.