When it comes to funding their next deal, real estate investors and entrepreneurs are privy to several lending options virtually made for real estate. Each comes with certain requirements to access, and if used properly, can be of huge benefit to investors.

One of these lending types is hard money lending. So, first, what is hard money?

What is Hard Money?Hard money refers to a type of lending mainly used in real estate investing. It can also be termed an asset-based loan or a STABBL loan (short-term asset-backed bridge loan) or a bridge loan.

These are derived from its characteristic short-term nature and the need for tangible, physical collateral, usually in the form of real estate property.

What is a Hard Money Loan?

A hard money loan is a loan type that is backed by or secured using a real property. Hard money loans are not offered by banks and are generally offered by individual investors or private lenders.

They are regarded as short-term bridge loans and the major use case for hard money loans is in real estate transactions.

They are considered a “hard” money loan because of the physical asset — the real estate property — required to secure the loan. In the event that a borrower defaults on the loan, the lender reserves the right to assume ownership of the property in order to recover the loan sum.

Requirements for Getting a Hard Money Loan

Hard money loans are non-conforming, and as such, do not use the same requirements that traditional lenders apply. In the same vein, the non-conforming nature affords the lenders a chance to decide on their own specific requirements.

As a result, requirements may vary significantly from lender to lender. If you are seeking a loan for the first time, the approval process could be relatively stringent and you may be required to provide additional information.

Here are some of the likely requirements or actions most hard money lenders will take:

- Verification of property value

- Review borrower’s investment history

- Financial contribution from the borrower to the loan, which often comes in the form of a down payment but may also be required to advance construction. Contribution amounts vary based on property type, location, and borrower experience. Generally, it may range from 30% to 40% for commercial properties and 10% to 30% for residential properties

- Underwriting or servicing fees (from $500 to $5000)

- Origination fee/points (1% to 5% of the total loan sum)

- Closing costs

After working with the same borrower a number of times without defaulting, the process would typically become easier and faster as well.

Why Use a Hard Money Loan?

Hard money loans are a solid avenue to secure quick funding for real estate investments. This is why they are mainly accessed by real estate entrepreneurs who would typically require rapid financing in order to not miss out on hot opportunities.

In addition, the lender mainly considers the value of the asset or property to be purchased rather than the borrower’s personal finance history such as credit score or income. This implies that the approval process moves along faster than conventional loans. A conventional or bank loan may take up to 45 days to close while a hard money loan can be closed in 7 to 10 days, sometimes sooner.

The convenience and speed that hard money loans offer remain a major driving force for why real estate investors choose to use them.

What Can a Hard Money Loan be Used For?

Hard money loans are mainly used for real estate investments that have a quick turnaround. This is apparent in the case of house flippers. However, beyond this, they also see other uses:

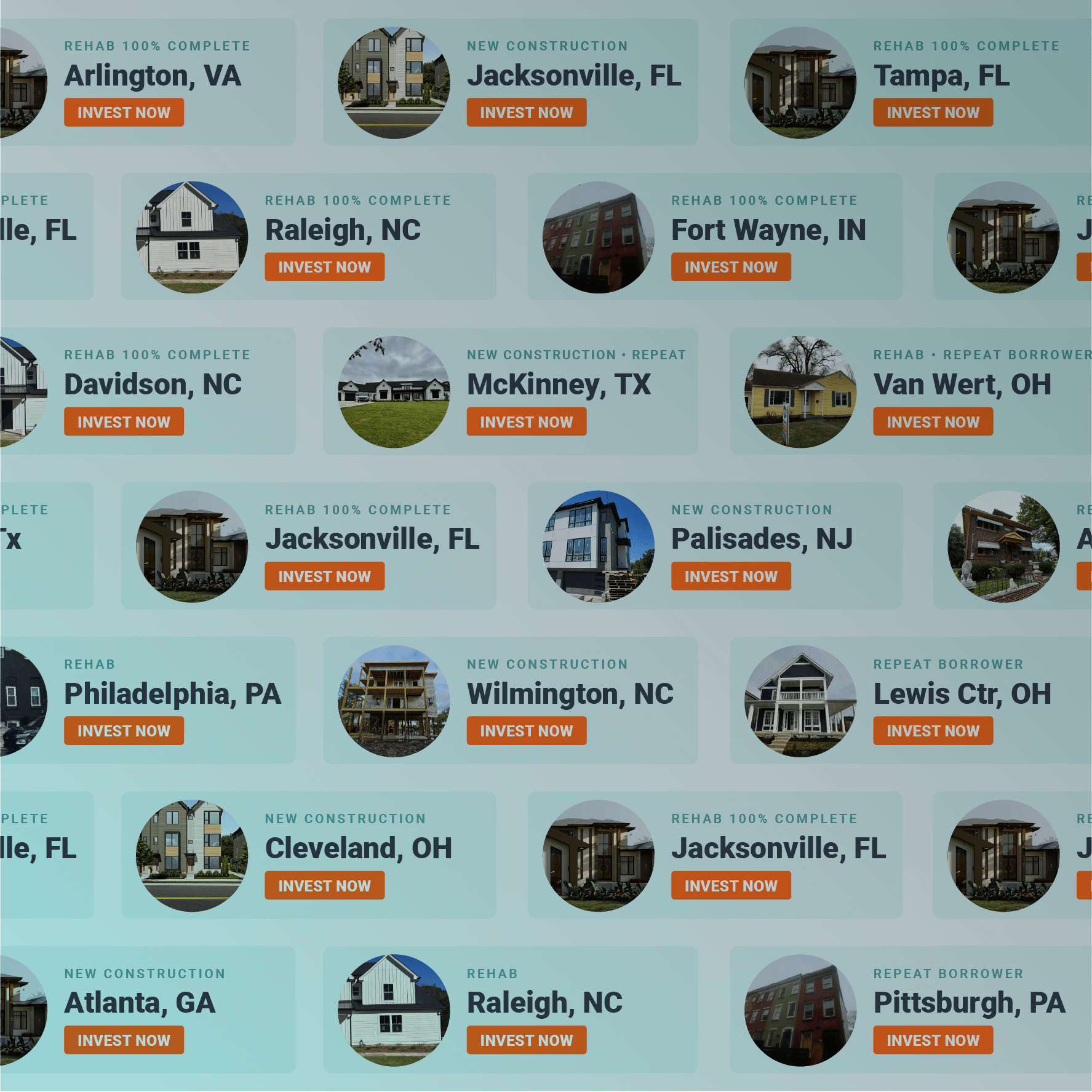

Investment Property Purchase

Real estate investors who are unable to access traditional financing to invest in a rental property may opt for a hard money loan instead.

In addition, a hard money loan presents a great financing source if the investor needs more money than they can access or put up toward the investment, or in the event that a property is in such distressed condition that a bank may be hesitant to lend on it

House Flipping

House flippers are the primary users of hard money loans. They purchase distressed properties with a potential good resale value, fix them up by making repairs and renovations that add value, and then sell them for profit.

These projects are usually completed rapidly, hence the need for quick access to funds. Profit from the project can be used as a down payment on the next, therefore, hard money loans allow investors to scale and flip more properties per time. Given that the fixing to resale time frame is short (typically less than a year), house flippers do not need the long-term loans that traditional mortgage lenders offer.

So, they would rather opt for hard money loans with a repayment duration of 6 to 18 months, (or at Fund That Flip, 6 to 12 or 6 to 18 months). Also, a direct, hard money lender like Fund That Flip requires that the house flippers be experienced.

Commercial Property Purchase

Certain commercial properties may not qualify for conventional financing. In other cases, the funds being offered by a traditional lender may be insufficient. In cases like these, hard money loans allow entrepreneurs to purchase commercial property conveniently.

New Construction

A hard money loan may be required to complete new construction in the event that funds available run out. This way, the project is able to achieve completion within the set timeline.

What is a Hard Money Lender?

Traditional lenders may be considered the antithesis of hard money lenders. So, what is a hard money lender? Hard money lenders are usually private companies or individual investors who offer non-conforming, asset-based loans mainly to real estate investors.

Since the loans are non-conforming, lenders have the freedom to choose their own specific requirements on factors like debt-to-income ratios or credit scores that borrowers would need to have to qualify for a loan.

Usually, these factors are not the most important consideration for loan qualification. Rather, the value of the property or asset to be purchased, which would also be used as collateral, is primarily considered.

Interest rates may also vary based on the lender and the deal in question. Most lenders may charge interest rates ranging from 9% to even 12% or more. The risk involved is also taken into consideration in determining the interest rate.

Hard money lenders would also charge a fee for providing the loan, and these fees are also known as “points.” They usually end up being anywhere from 1- 5% of the total loan sum, however, points would usually equal one percentage point of the loan.

How Does a Hard Money Lender Differ from Other Lenders?

The major difference between a hard money lender and other lenders lies in the approval process. Other lenders are mainly concerned with the creditworthiness of the borrower.

A hard money lender, on the other hand, focuses on the asset to be purchased as the top consideration. Credit scores, income, and other individual requirements come secondary.

They also differ in terms of ease of access to funding and interest rates; hard money lenders provide funding rapidly and charge higher interest rates as well.

How To Find a Hard Money Lender

Finding a hard money lender is relatively easy and only requires some shopping around. You could find one in one of the following ways:

- A simple internet search

- Request recommendations from local real estate agents

- Request recommendations from real estate investors/ investor groups

Since the loans are non-conforming, you should take your time reviewing the requirements and terms offered before making a calculated and informed decision.

Conclusion

Although hard money loans feature high-interest rates and significant closing costs, they are an excellent and fast funding source for real estate projects. It is essential to run the figures before opting for a hard money loan to ensure that you do not run into any loss.

Apply for your hard money loan today and get a loan commitment in 24 hours.